Kuwait Hotel Industry 2025: Market Trends, Growth Forecasts & Investment Opportunities

.avif)

Introduction

With 13,593 hotel rooms spread across 136 properties and occupancy projected to rise to 56–60% by 2026, Kuwait’s hotel sector is poised for strategic investment and transformation.

Kuwait's hospitality domain stands at a pivotal juncture, demonstrating remarkable resilience and intelligent repositioning as it emerges from the pandemic toward an ambitious growth trajectory. The sector’s sophisticated dynamics offer compelling openings for investors, operators, and stakeholders eager to capitalise on the region's evolving tourism and business-travel landscape.

This comprehensive analysis, prepared by Ali Bahbahani & Partners, examines the market’s architecture, competitive positioning, and strategic growth prospects across all accommodation tiers. Our insights are informed by extensive market data and operational expertise, providing stakeholders with actionable intelligence at a pivotal moment for the industry.

Kuwait Hospitality Market 2025: Current State and Evolution

The 2025 market represents a sophisticated ecosystem in the midst of strategic transition. International brands now control roughly 54% of total keys (≈ approximately 7,340 rooms), while independents retain 46% (≈ approximately 6,253 rooms), creating fertile ground for both established players and agile entrants.

Market Overview and Recovery Trajectory

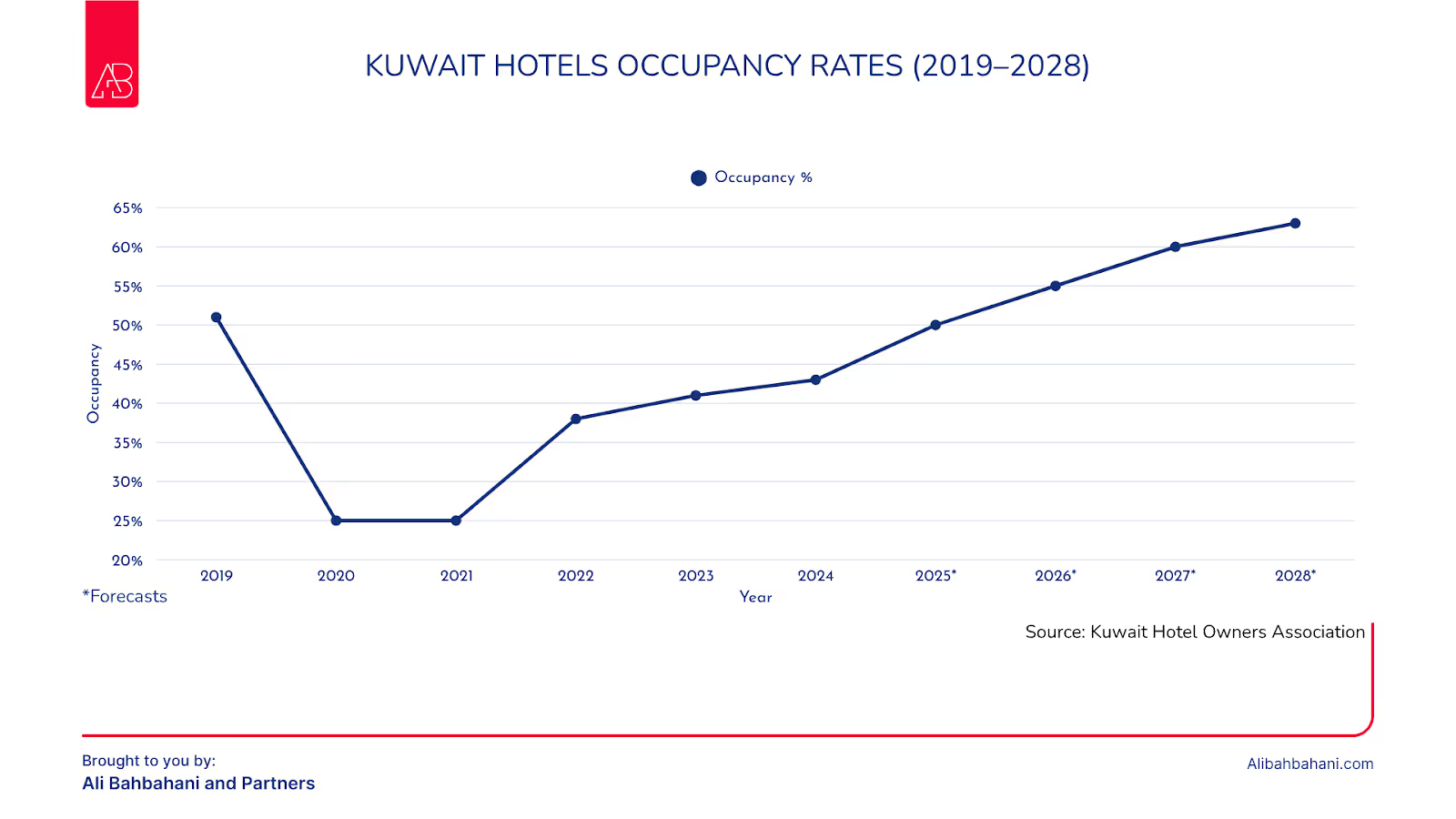

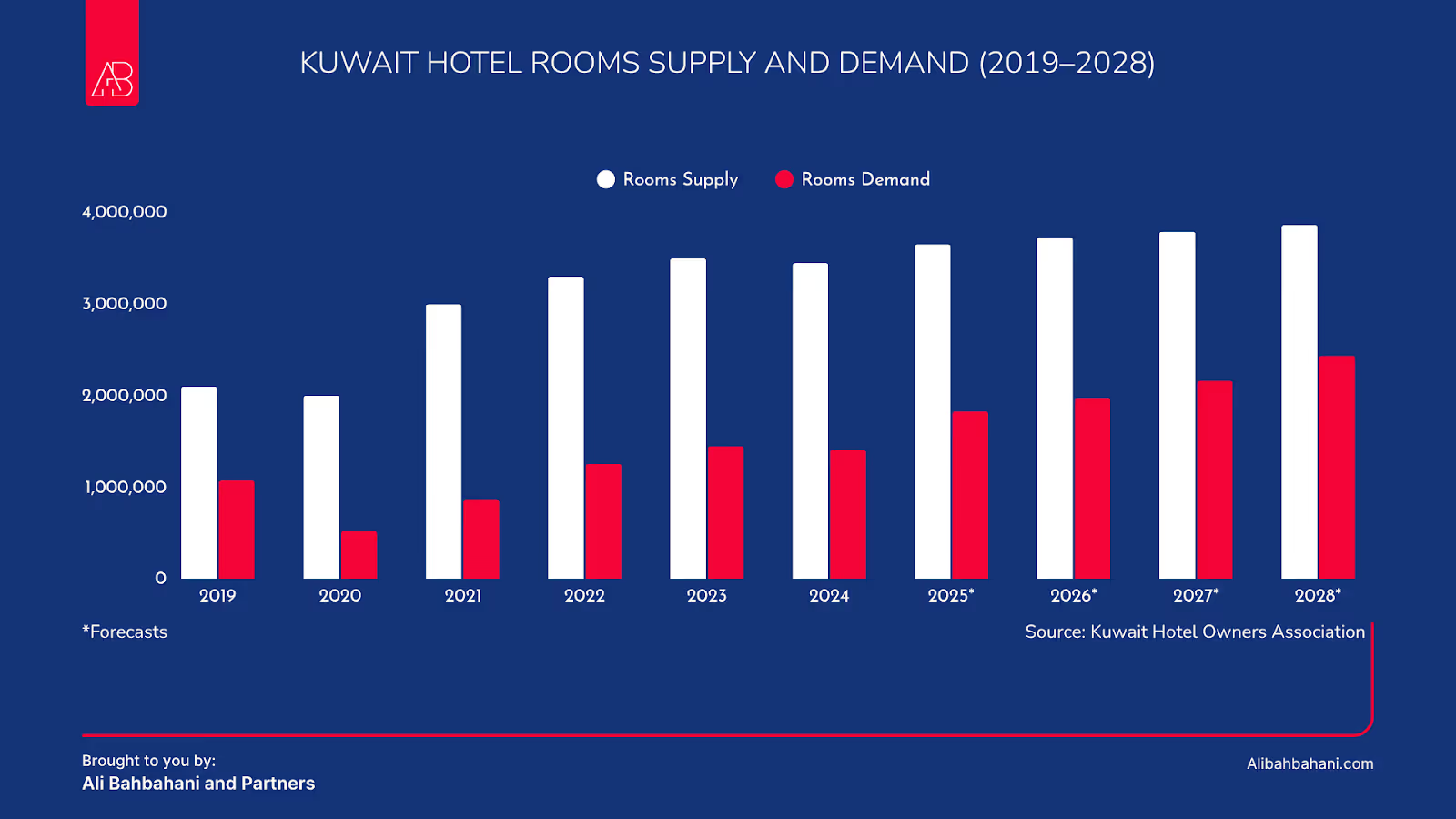

Occupancy has rebounded from pandemic lows of 25% (2020-21) to the mid-40% range in 2024. Consensus points to 56 – 60 % by 2026, driven by:

- Corporate Travel Normalisation – oil and gas sector rebound driving weekday demand

- Persistent Staycation Culture – local families swapping outbound trips for domestic hotel experiences

- MICE Resurgence – Vision 2035 infrastructure fuelling conference volume

- Technology Transformation – 23 % of guests now book inside 48 h, rewarding dynamic pricing engines

Collectively, 136 hotels generate approximately 4.96 million saleable room nights each year, an economic lever squarely aligned with Kuwait’s diversification agenda. The figures from the above graph are based on the Kuwait Hotel Owners Association figures that may not take into account apartment hotels. We have tried to estimate all possible accomodations that includes hotels, resorts, chalets, apartment hotels, and hostels.

Kuwait's Largest Hotels: Market Leaders by Room Count

- Four Points by Sheraton – 406 rooms

- Jumeirah Messilah Beach – 405 rooms

- Hilton Garden Inn – 385 rooms

- Hilton Kuwait Resort – 350 rooms

- Holiday Inn Al Thuraya – 336 rooms

- JW Marriott Kuwait City – 313 rooms

- Grand Hyatt – 302 rooms

- Sea Shell Julai'a – 300 rooms

- Millennium Convention Centre – 295 rooms

- Four Seasons – 284 rooms

*Renovations temporarily remove 663 rooms from active stock, creating a near-term supply squeeze.

Strategic Observations

Brand Power Dominance

8 out of 10 are internationally recognized, underscoring their global distribution muscle.

Operational Scale Benefits

Hotels with over 300 rooms leverage economies of scope through extensive food and beverage, meeting, and leisure revenue streams.

Short-Run Tightness

The two closures shrink the live supply by ~5%, giving nearby competitors pricing leverage.

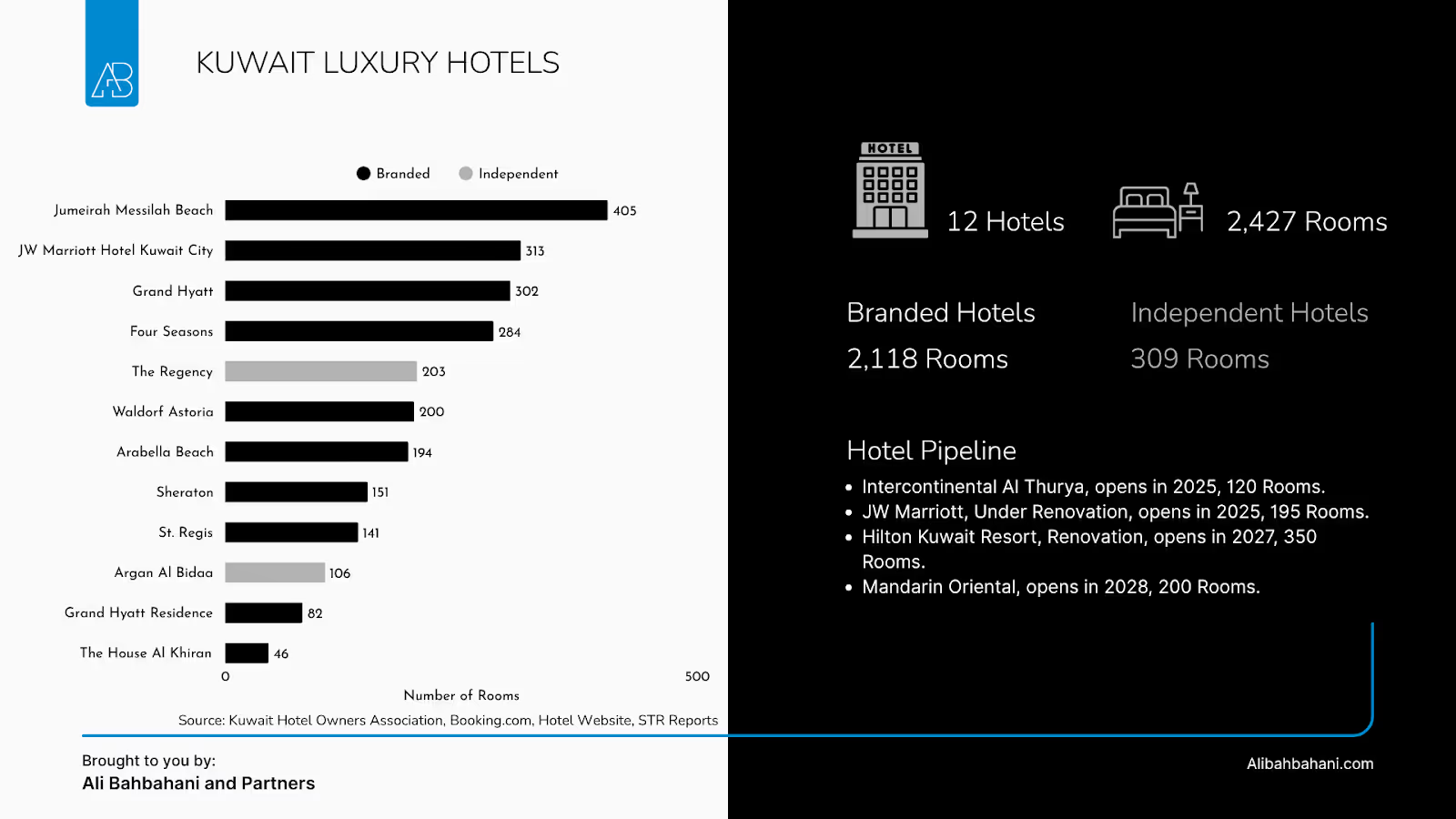

Kuwait Luxury Hotel Segment Analysis: Premium Positioning and Brand Concentration

The luxury tier comprises 12 properties and 2,427 keys, posting ADRs ranging from 65 to 160 KWD (the lower bound captures boutique outliers, such as Arabella at 67 KWD and Argan at 70 KWD). Branded hotels represent 77 % of rooms, reflecting Kuwait’s sophisticated, brand-savvy clientele.

- Jumeirah Messilah Beach – 405 rooms

- JW Marriott Hotel Kuwait City – 313 rooms

- Grand Hyatt – 302 rooms

- Four Seasons – 284 rooms

- The Regency (Independent) – 203 rooms

- Waldorf Astoria – 200 rooms

- Arabella Beach – 194 rooms

- Sheraton – 151 rooms

- St. Regis – 141 rooms

- Argan Al Bidaa (Independent) – 106 rooms

Smaller Properties

- Grand Hyatt Residence – 82 rooms

- The House Al Khiran (Independent) – 46 rooms

Totals

- 12 Hotels

- 2,427 Rooms

- Branded Hotels: 2,118 rooms

- Independent Hotels: 309 rooms

Hotel Pipeline

- Intercontinental Al Thuraya – 120 rooms (opens 2025)

- JW Marriott (renovation) – 195 rooms (reopens 2025)

- Hilton Kuwait Resort (renovation) – 350 rooms (reopens 2027)

- Mandarin Oriental – 200 rooms (opens 2028)

Kuwait Upper Upscale Hotel Segment: Strategic Balance and Operational Diversity

Eleven properties, totaling 1,859 rooms, are located here; global brands control 58%, while independents control 42%.

- Hilton Kuwait Resort – 350 rooms

- Sea Shell Julai’a (Independent) – 300 rooms

- Hyatt Regency Al Kout Mall – 200 rooms

- Radisson Blu – 190 rooms

- Symphony Style – 175 rooms

- Al Kout Beach (Independent) – 174 rooms

- The Palms Beach & Spa (Independent) – 169 rooms

- Marriott Executive – 164 rooms

- Palazzo (Independent) – 66 rooms

- Rayz (Independent) – 56 rooms

- The 58 Mahboula (Independent) – 11 rooms

Totals

- 11 Hotels

- 1,859 Rooms

- Branded Hotels: 1,079 rooms

- Independent Hotels: 780 rooms

Hotel Pipeline

- Park Inn – 250 rooms (opens 2025)

- Mysk Hotel – 202 rooms (opens 2026)

Transitioning Down the Price Spectrum, Stepping down the price ladder from luxury and upper-upscale properties reveals a fascinating shift in market dynamics. While international brands dominate the premium segments, Kuwait's mid-market and economy tiers tell a different story, one where local operators leverage market knowledge and operational agility to capture significant market share. This transition becomes particularly pronounced in the upscale segment, where volume leadership meets diverse operational strategies.

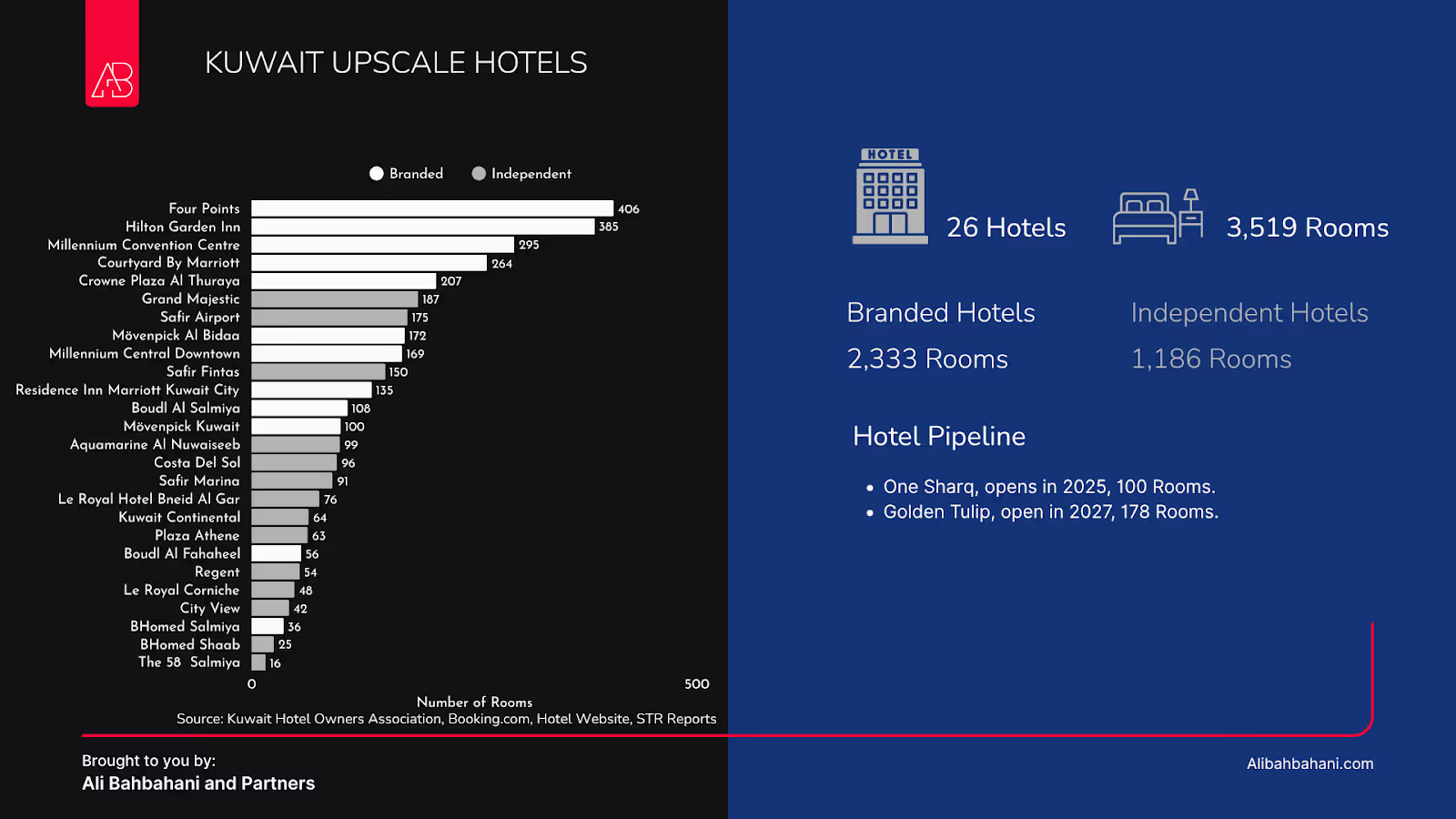

Kuwait Upscale Hotel Segment: Volume Leadership and Strategic Diversity

26 hotels | 3,519 rooms

Brands: 66 % | Independents: 34 %

- Four Points – 406 rooms

- Hilton Garden Inn – 365 rooms

- Millennium Convention Centre – 295 rooms

- Courtyard by Marriott – 264 rooms

- Crowne Plaza Al Thuraya – 207 rooms

- Grand Majestic (Independent) – 187 rooms

- Safir Airport – 175 rooms

- Mövenpick Al Bidaa – 172 rooms

- Millennium Central Downtown – 169 rooms

- Safir Fintas – 150 rooms

- Residence Inn Marriott Kuwait City – 135 rooms

- Boudl Al Salmiya – 108 rooms

- Mövenpick Kuwait – 100 rooms

- Aquamarine Al Nuwaiseeb (Independent) – 99 rooms

- Costa Del Sol (Independent) – 96 rooms

- Safir Marina – 91 rooms

- Le Royal Hotel Beirut Al Gara – 76 rooms

- Kuwait Continental (Independent) – 64 rooms

- Plaza Athenee (Independent) – 63 rooms

- Boudl Al Fahheel – 56 rooms

- Regent (Independent) – 54 rooms

- Le Royal Corniche – 48 rooms

- City View (Independent) – 42 rooms

- BHotel Salmiya (Independent) – 36 rooms

- BHotel Shaab (Independent) – 25 rooms

- The 58 Salmiya (Independent) – 16 rooms

Totals

- 26 Hotels

- 3,519 Rooms

- Branded Hotels: 2,333 rooms

- Independent Hotels: 1,186 rooms

Hotel Pipeline

- One Sharq – 100 rooms (opens 2025)

- Golden Tulip – 178 rooms (opens 2027)

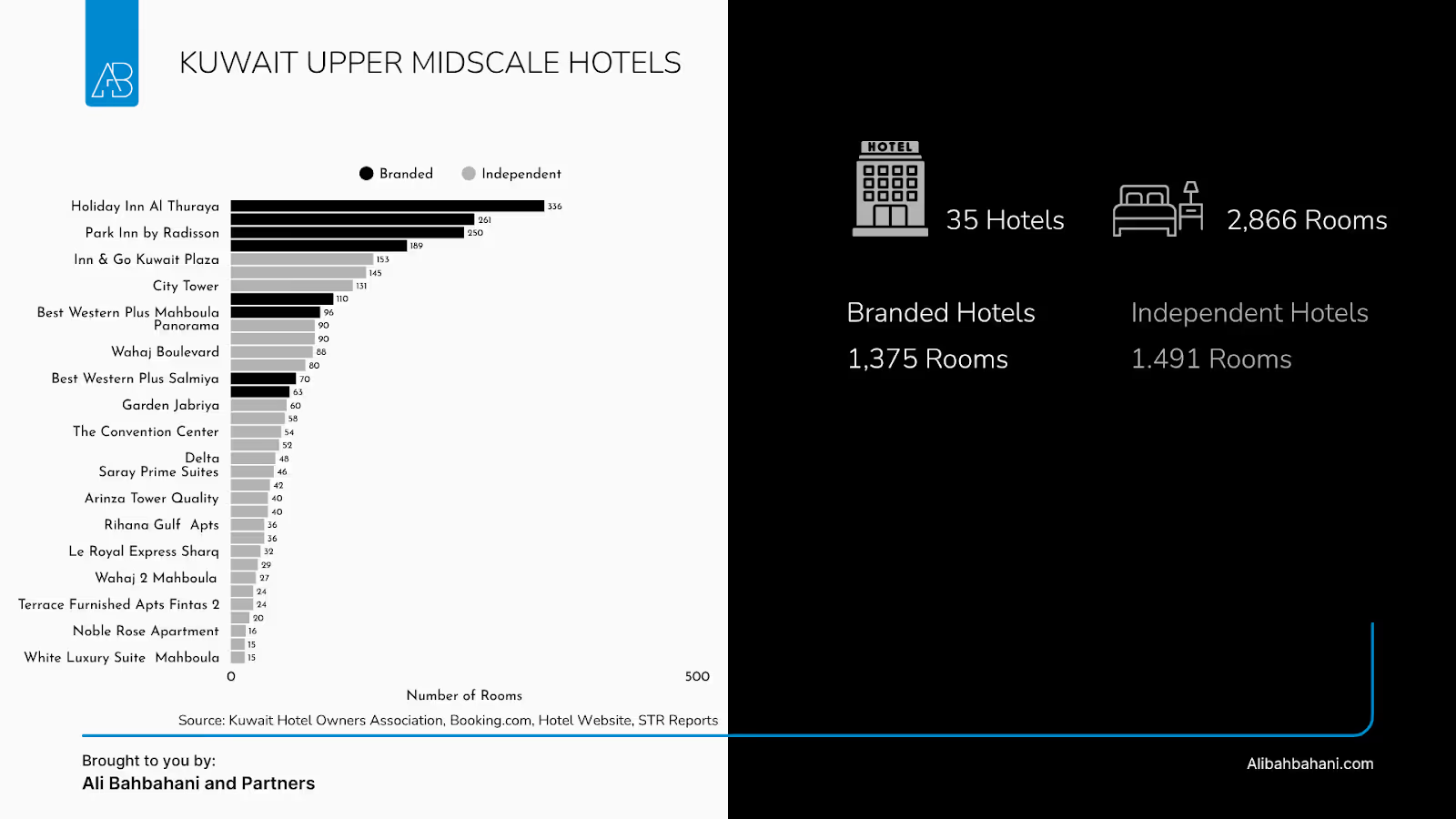

Kuwait Upper Midscale Hotel Segment: Independent Entrepreneurship Hub

35 hotels | 2,866 rooms

Independents lead with 52 % share; brands hold 48 %

Park Inn by Radisson soft-opened in 2024, signalling intensified brand interest.

- Holiday Inn Al Thuraya – 356 rooms

- Park Inn by Radisson – 166 rooms

- Inn & Go Kuwait Plaza – 153 rooms

- City Tower (Independent) – 145 rooms

- Best Western Plus Mahboula – 116 rooms

- Panorama (Independent) – 90 rooms

- Wahaj Boulevard (Independent) – 90 rooms

- Best Western Plus Salmiya – 80 rooms

- Garden Jabriya (Independent) – 62 rooms

- The Convention Center – 54 rooms

- Delta (Independent) – 52 rooms

- Saray Prime Suites (Independent) – 48 rooms

- Arinza Tower Quality – 46 rooms

- Rihana Gulf Apartments (Independent) – 40 rooms

- Le Royal Express Sharq – 36 rooms

- Wahaj 2 Mahboula (Independent) – 36 rooms

- Terrace Furnished Apts Fintas 2 (Independent) – 34 rooms

- Noble Rose Apartment (Independent) – 18 rooms

- White Luxury Suite Mahboula (Independent) – 15 rooms

Totals

- 35 Hotels

- 2,866 Rooms

- Branded Hotels: 1,375 rooms

- Independent Hotels: 1,491 rooms

Kuwait Midscale Hotel Segment: Local Operator Dominance

39 hotels | 2,215 rooms

Independents command 80 % of keys; Accor’s Ibis twins anchor the branded 20 %.

- Ibis Salmiya – 187 rooms

- Ramal Riggae – 160 rooms

- Al Hamra – 150 rooms

- Carlton Tower Kuwait – 90 rooms

- Kuwait Palace – 90 rooms

- The Code Residence – 80 rooms

- Oasis – 70 rooms

- The Rester – 70 rooms

- Le Royal Express Salmiya – 60 rooms

- Magic Suite Tower (Mahboula) – 50 rooms

- Continental Suite Farwaniya – 50 rooms

- Magic Suite Abu Halifa – 40 rooms

- Divona – 40 rooms

- Continental Suite Salmiya – 40 rooms

- Magic Suite Plus – 35 rooms

- Gulf Continental Suite – 30 rooms

- Magic Suite Mahboula 5 – 30 rooms

- Magic Suite Mahboula 3 – 30 rooms

- Magic Suite Mahboula 2 – 30 rooms

- Atlantis International – 20 rooms

Totals

- 39 Hotels

- 2,215 Rooms

- Branded Hotels: 438 rooms

- Independent Hotels: 1,777 rooms

Kuwait Economy Hotel Segment: Hyper-Local Focus

13 hotels | 707 rooms

Independents operate 93% of the stock; Swiss-Belinn Sharq (51 rooms) is the lone global flag.

- Riggae Tower – 90 rooms

- Al Dana – 60 rooms

- Adams – 60 rooms

- Leaders Plaza Salmiya – 60 rooms

- Blue Waves Abu Halifa – 57 rooms

- Sama Palace – 56 rooms

- Bravo Royal Suites – 54 rooms

- Laguna Suites – 52 rooms

- Swiss-Belinn Sharq – 51 rooms (Branded)

- Sama Plaza – 50 rooms

- Marina Royal Suites – 49 rooms

- Gulf Grand – 24 rooms

- Salmiya Casa – 24 rooms

Totals

- 13 Hotels

- 707 Rooms

- Branded Hotels: 51 rooms

- Independent Hotels: 656 rooms

Strategic Implications by Segment

Each segment reveals distinct investment and operational opportunities:

- Upscale: Scale advantages and brand power dominate; opportunities in MICE and extended-stay

- Upper Midscale: Most competitive segment with balanced brand/independent mix; ripe for differentiation

- Midscale: Fragmented market ideal for consolidation plays and tech-enabled operations

- Economy: Hyper-local focus with minimal brand penetration; opportunity for budget brand entry

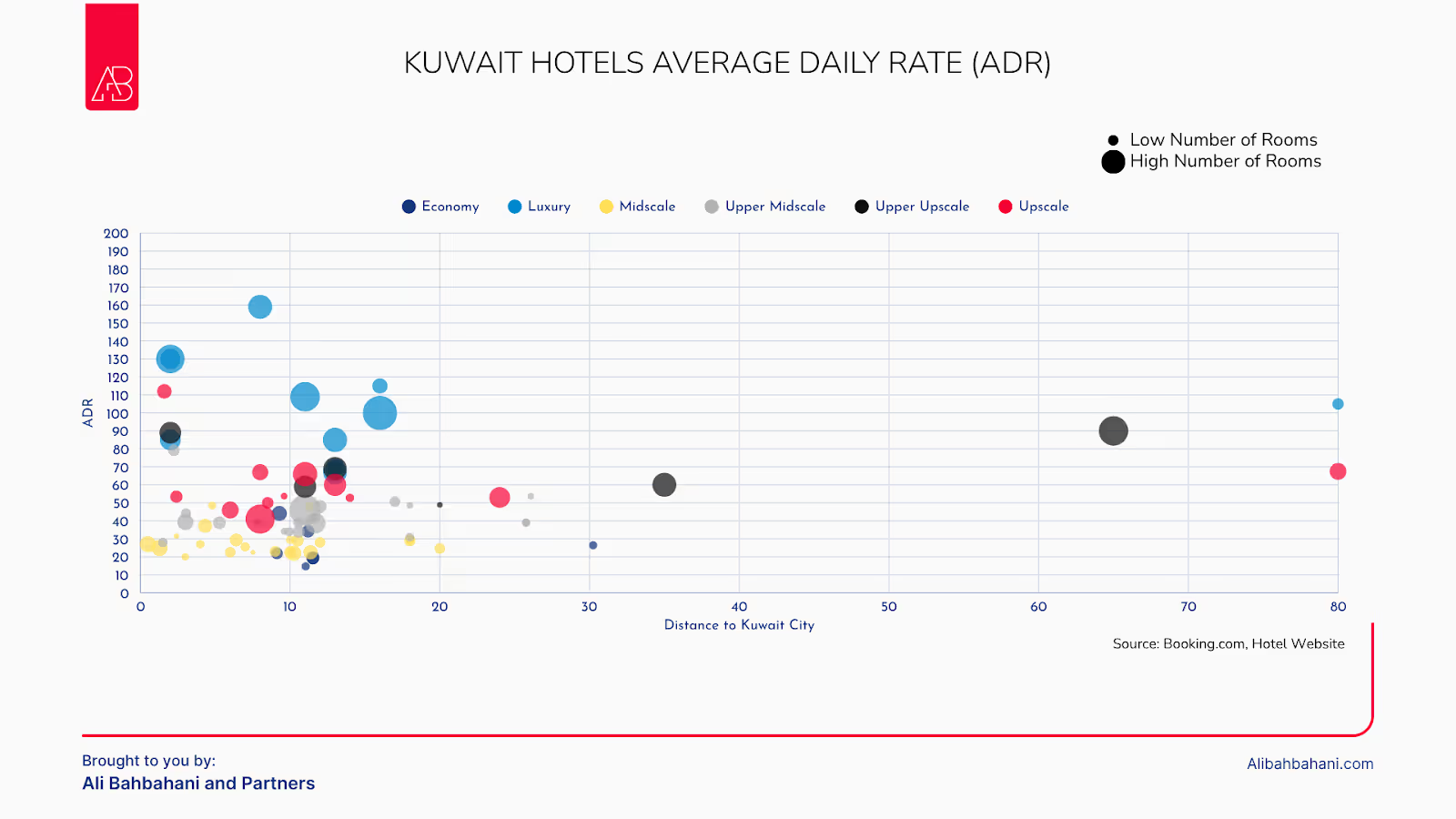

Kuwait's Hospitality Pricing Strategy: Location Premium and Market Positioning Analysis

Rule of thumb: every 10 km from CBD clips ADR by ~17 % unless beachfront or themed.

Kuwait's hotel Average Daily Rate (ADR) distribution reveals sophisticated pricing dynamics that directly correlate with geographic positioning and market segmentation strategies. The chart above demonstrates clear pricing hierarchies that reflect both operational positioning and customer value perception within Kuwait's competitive landscape.

Geographic Premium and Strategic Location Value

The market exhibits pronounced location-based pricing premiums, with luxury properties commanding ADRs ranging from 65 KWD to 160 KWD within the prime 0-15 kilometer radius from Kuwait City center. This concentration demonstrates the strategic value of central positioning, where proximity to business districts, cultural attractions, and transportation infrastructure enables premium pricing that justifies higher operational costs and real estate investments.

Notably, the luxury segment's pricing dispersion - from 65 KWD for smaller properties to 160 KWD for larger establishments - indicates that operational scale amplifies location advantages, enabling larger luxury properties to capture maximum market premiums through enhanced service offerings and operational efficiencies.

Market Segmentation and Pricing Architecture

The clear segmental pricing boundaries reveal sophisticated market positioning strategies:

- Luxury Properties: 65-160 KWD within 15km, with outliers at 65-90km achieving 100-105 KWD

- Upscale Hotels: 40-70 KWD, maintaining consistency across locations

- Upper Midscale: 50-90 KWD showing location sensitivity

- Midscale: 20-50 KWD with minimal location premium

- Economy: 15-35 KWD focused on price-sensitive segments

Distance-Based Value Proposition Dynamics

The emergence of viable hospitality operations at 40-80 kilometer distances from Kuwait City, with average daily rates (ADR) ranging from 60-100 KWD, suggests successful alternative positioning strategies that leverage resort-style amenities, specialized facilities, or unique location advantages to offset distance premiums. These outliers demonstrate that strategic differentiation can overcome geographic disadvantages by delivering an enhanced value proposition.

Investment and Revenue Optimization Implications

For stakeholders, the data reveals critical insights:

- Central Kuwait City positioning enables 50-100% pricing premiums over peripheral locations

- Operational scale within the luxury and upscale segments directly correlates with revenue optimization potential

- The "sweet spot" for new developments lies within 20km of the city center for business hotels

- Beyond 40km, only destination resorts or unique concepts justify development

This analysis confirms that location selection is the primary determinant of sustainable revenue performance across all market segments.

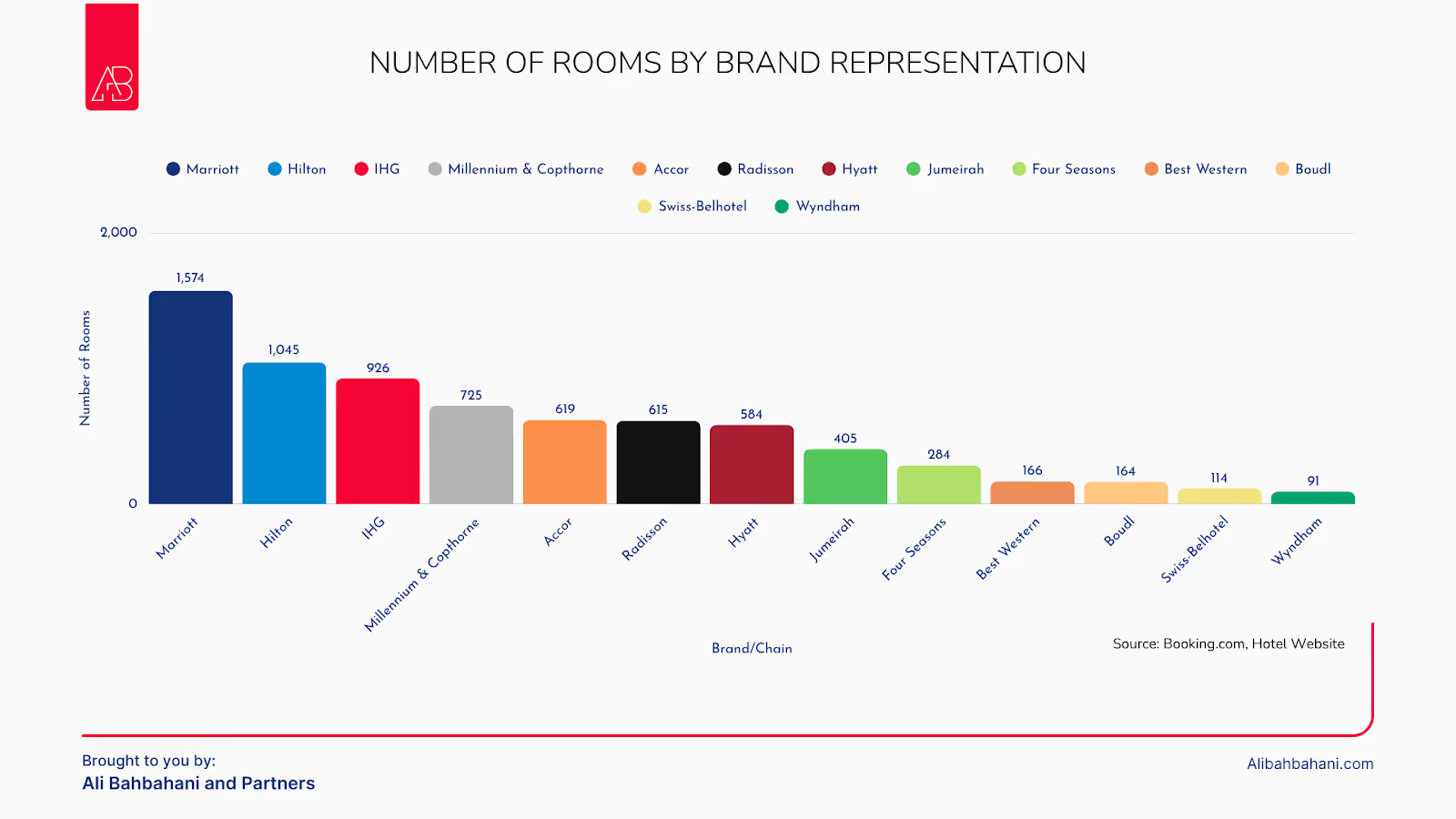

Kuwait's International Brand Portfolio: Strategic Market Concentration and Competitive Positioning

Kuwait's hospitality brand landscape exhibits significant market concentration among leading international operators, with 13 major brands controlling a substantial portion of the room inventory. The chart above reveals strategic positioning dynamics and competitive advantages within the regional hospitality ecosystem, providing critical insights into market penetration strategies and investment partnership opportunities.

Market Leadership and Strategic Scale Advantages

Marriott International establishes a commanding market leadership position with 1,574 rooms, representing approximately 12% of Kuwait's total supply, or around 21% of the branded rooms. This substantial presence enables:

- Operational synergies across multiple properties

- Customer loyalty program optimization

- Economies of scale create competitive advantages

- Portfolio diversification across luxury (St. Regis), upscale (Four Points), and extended-stay (Residence Inn)

Hilton's 1,045-room presence and IHG's 926-room portfolio validate multi-brand strategies that capture varied customer segments while optimizing operational efficiencies across Kuwait's diverse demand patterns

Mid-Tier Brand Competition and Market Positioning

The clustering of brandswithin the 600-700 room range reveals intense competition for secondary marketpositioning:

Specialized Brand Positioning

Focused strategies demonstrate alternative paths to success:

- Jumeirah: 405 rooms in a single flagship beachfront property

- Four Seasons: 284 rooms prioritizing ultra-luxury positioning

- Best Western: 166 rooms targeting suburban markets

- Boudl: 164 rooms as regional brand entry

- Swiss-Belhotel: 114 rooms in managed properties

- Wyndham: 91 rooms through Ramada Encore

These positioning approaches validate that a strategic market focus can generate sustainable advantages through enhanced customer experiences and optimized premium pricing.

Strategic Implications for Market Development

The brand distribution reveals critical opportunities:

- For New Entrants: Partnership opportunities exist in underserved segments (economy, extended-stay)

- For Existing Brands: Scale expansion potential through conversion of independent properties

- For Investors: Portfolio plays combining multiple brands can achieve operational synergies

- For Independent Hotels: Brand affiliation can access global distribution and revenue management systems

The concentration of 54% branded inventory leaves significant room for brand expansion, particularly in midscale and economy segments where independents currently dominate.

Post-Pandemic Market Transformation

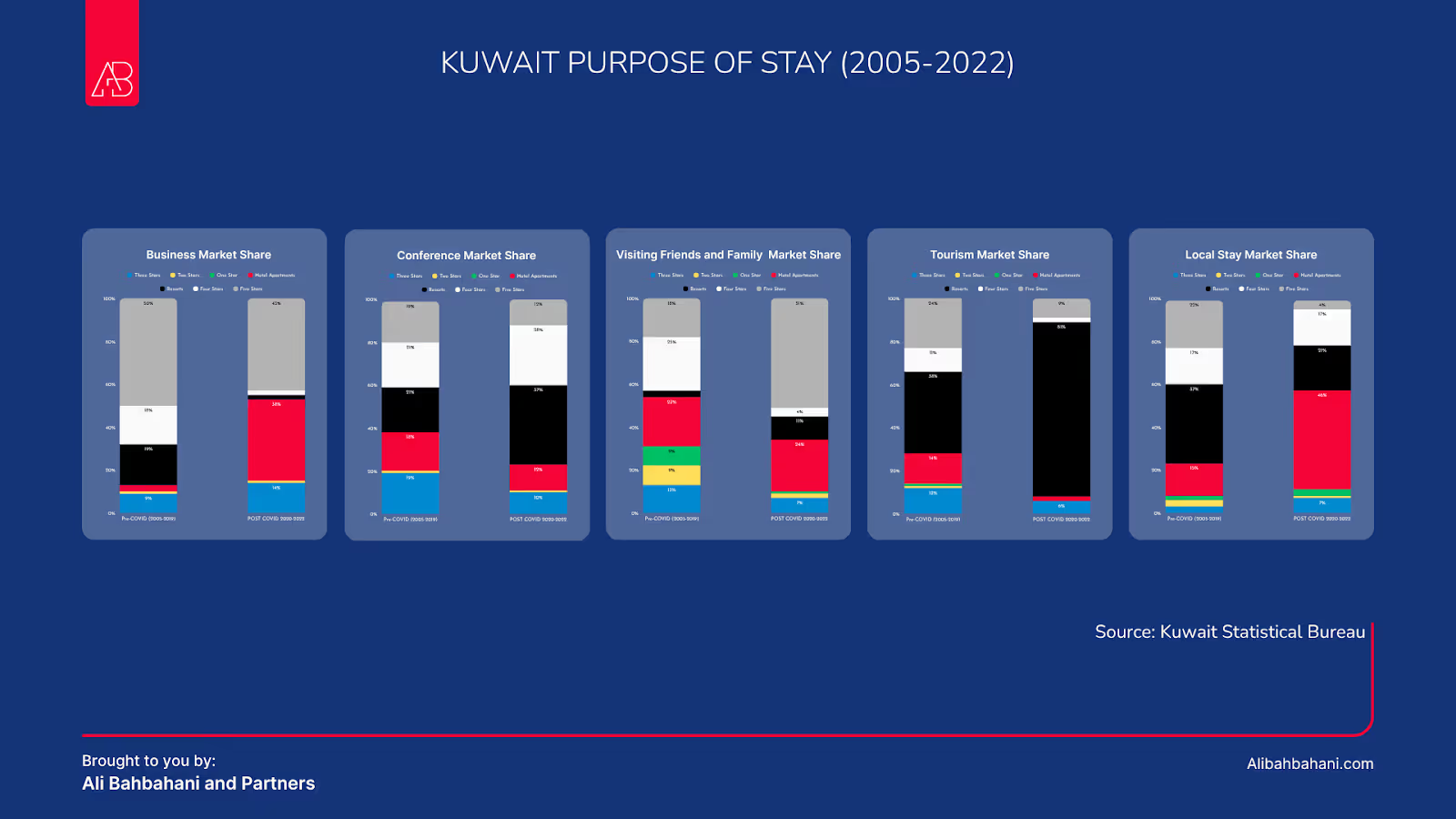

Purpose of Stay Evolution

The pandemic fundamentally transformed accommodation preferences across all traveler segments. These shifts align with broader hospitality trends explored in our analysis of The Future of Hospitality: Trends and Innovations:

Market Share Redistribution

The structural shifts reveal permanent changes in traveler preferences:

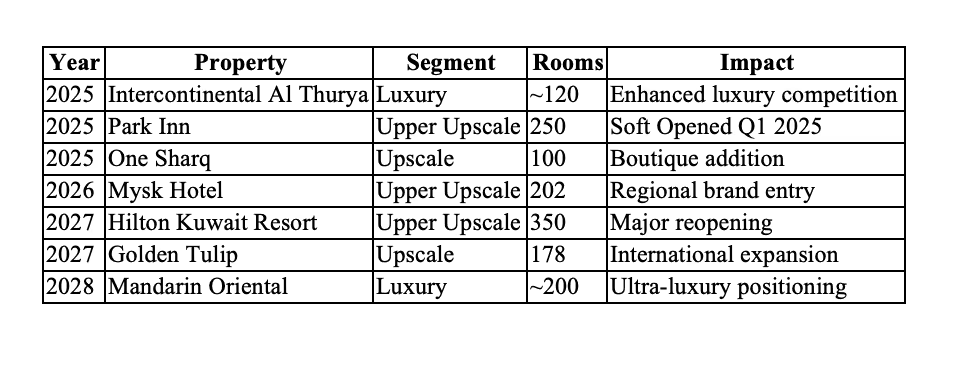

Development Pipeline: 2,000+ Rooms Adding 10% Capacity by 2028

Kuwait's hospitality pipeline through 2028 includes strategic additions across multiple segments, representing approximately 10% capacity expansion:

*Room counts for InterContinental and Mandarin Oriental are industry estimates; combined with listed projects, they lift total pipeline to just over 2,000 keys—roughly 10 % of today’s inventory.

Confirmed Developments

*Room counts for InterContinental and Mandarin Orientalare industry estimates; combined with listed projects, they lift total pipelineto just over 2,000 keys—roughly 10 % oftoday’s inventory.

Investment Opportunities and Strategic Recommendations

Immediate Action Items

- Suburban Development Focus

- Target: 150-250 room upper-midscale hotels

- Timeline: Complete before the 2027 supply wave

- Brand Conversion Opportunity

- Target: Independent midscale/economy properties

- Extended-Stay Development

- Focus: Convert existing 4★ properties with extensive room inventories

- Demand Drivers: Business (38%), staycations (46%), transit (42%)

- Resort Repositioning

- Capture: 81% of tourism nights, 37% of MICE events

- Concepts: Wellness retreats, work-from-resort packages

- Investment: Enhanced F&B and recreational facilities

Geographic Investment Strategy

- Within 5km of City Center: Premium positioning across all segments

- Coastal Locations (10-20km): Resort and lifestyle concepts offsetting distance

- Suburban Markets (20-40km): Value-driven concepts with unique experiences

- Desert/Remote (40-80km): Destination resorts with compelling narratives

Strategic Insights for Owners and Operators

Five Critical Market Dynamics

- Serviced Apartments: The Clear Winners

- Captured +8 percentage points market share post-COVID

- Opportunity: Convert older 4★ properties with large rooms into branded aparthotels

- Resort Dominance in Events

- 81% of tourism nights and 37% of conference nights are now in resorts

- Strategy: Develop wellness retreats, micro-weddings, and "work-from-resort" packages

- Three-Star Workforce Transformation

- 95% of the contractor/crew stays shifted to 3★ properties

- Requirements: Streamlined group check-in, robust meal plans, efficient laundry services

- Four-Star "Middle-Child Syndrome"

- Lost 5pp market share across all segments

- Solution: Dual positioning with premium floors for business and budget pods for transit (a "barbell approach"—offering both high-end and economy options within one property)

- Narrowed Premium Demand

- Five-star share dropped 7pp but maintains strength in VIP and C-suite business

- Focus: Bleisure amenities (combining business and leisure features), digital concierge, and culture-driven experiences

Market Outlook: Three Scenarios (2025-2028)

Occupancy Projections by 2027

- Optimistic Scenario (65% Occupancy)

- Visa reforms implemented for GCC+3 markets

- Strong Vision 2035 execution drives MICE growth

- Surge in bleisure tourism (business + leisure trips) from regional markets

- Base Case (58% Occupancy)

- Steady corporate recovery aligned with the oil sector

- Moderate leisure uptake with balanced supply additions

- Consistent 2-3% annual occupancy growth

- Conservative Scenario (52% Occupancy)

- Economic headwinds impact business travel

- Regional competition intensifies

- Slower infrastructure development delays tourism growth

Regional Context: Kuwait's Position in the GCC Hospitality Landscape

Kuwait's hospitality market demonstrates unique characteristics when compared to its GCC neighbors, offering both challenges and opportunities for investors:

GCC Hospitality Market Comparison

Strategic Implications

Kuwait's smaller market size presents opportunities for focused positioning:

- Lower Competition: Fewer total rooms mean less saturation compared to Dubai or Saudi Arabia

- Higher Serviced Apartment Demand: Leading the region at 23% market share

- Moderate Growth Pipeline: 15% expansion allows for sustainable absorption

- Untapped International Potential: Lower brand penetration offers franchise opportunities

Transform Your Hospitality Investment with Expert Advisory

As Kuwait's hospitality sector accelerates toward its ambitious 2028 growth targets, the right strategic partner can make the difference between market participation and market leadership. Ali Bahbahani and Partners specializes in hospitality consulting that transforms opportunities into sustainable competitive advantages.

Our Hospitality Consulting Services:

- Feasibility Studies & Market Entry - Data-driven analysis for new hotel developments and market positioning

- Hotel Concept Development - Creating differentiated hospitality concepts aligned with market opportunities

- Operational Excellence - Performance optimization for existing properties to maximize ADR and occupancy

- Strategic Repositioning - Transforming underperforming assets into market leaders

Ready to capitalize?

Contact Ali Bahbahani and Partners to discuss how our hospitality expertise can accelerate your success in Kuwait's dynamic market.

This market analysis represents the perspective of Ali Bahbahani and Partners, based on comprehensive market data and industry expertise. For customized strategic advisory services tailored to your specific hospitality investment or operational needs, please get in touch with our team.

.webp)